When pursuing a career in accounting, young professionals often ponder which designation will most align with their goals. Two of the most common professional designations in the world of accounting consist of the CPA and the CMA. Although the CPA has a much longer history and is often regarded as the most advanced, and even most credible professional designation that accountants can have, the CMA is growing rapidly and is becoming much more prevalent. If you are trying to decide between the CPA and the CMA, our team has outlined some key differences between both designations to give you the rundown.

CPA License:

The CPA license stands for Certified Public Accountant and is issued by the American Institute of Public Accountants (AICPA) which is the most highly regarded accounting organization in the United States. Although the Uniform CPA Examination is administered by the AICPA, the license itself is both distributed, suspended, and revoked by each individual state board of accountancy. The CPA license is often thought to be limited to conducting audits and issuing an independent audit report as well as filing income tax returns on behalf of clients. Although these services are most commonly provided by CPA’s, there is much more that professionals can elect to do with their license. CPA’s will frequently use their designation to leverage jobs in corporate finance as well as managerial accounting and investment management.

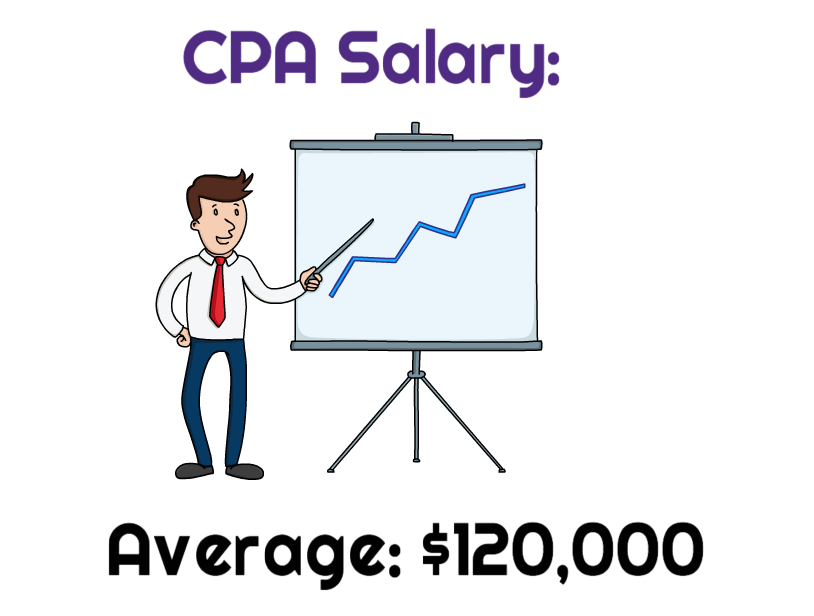

Salary:

Statistics show that the average salary of a Certified Public Accountant (CPA) in the United States will be based on standard factors (e.g. amount of work experience and what firm the professional works for.) The AICPA has conducted surveys and determined that the average salary of a CPA was $120,000 per year in 2019.

CMA Certification:

The CMA stands for Certified Management Accountant and is a professional certification that is globally recognized and administered by the Institute of Management Accountants (IMA). CMA’s are often thought of as a replacement to the CPA, but little might you know that many CPA professionals are getting a CMA to work side-by-side with their CPA license. Because the CMA is a professional certification, requirements for continuing education (CPE) are a bit less stringent than for sustaining a CPA license. However, CPE credits that are earned for CPA licensure may be applied toward the annual CMA requirement. The CMA certification requires that certified professionals earn 30 hours of CPE per year, of which at least 2 hours are required to be ethics training.

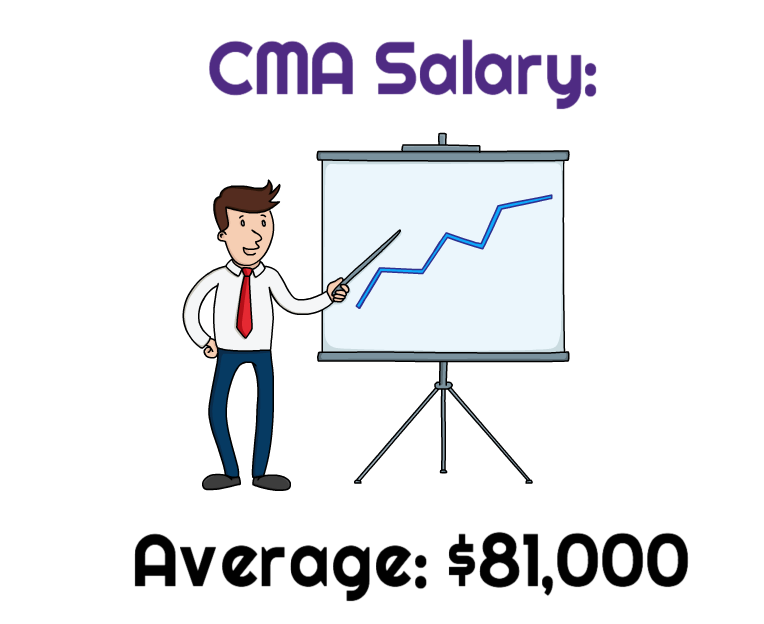

Salary:

CMA’s are often considered to allow accountants to have higher earning power.

The IMA’s 2019 Global Salary Survey indicates that:

- CMA’s earn 55% more in median total compensation compared to non-CMA’s.

- CMA’s between the ages of 20-29 can earn over 70% in total compensation than non-CMA’s.

- Surveys conducted show that the average CMA professional has an average salary of $81,000. However, keep in mind that CMA’s will also have a CPA in conjunction.

Bottom Line:

Both the CPA license and the CMA certification have pros and cons. Although both the CPA and the CMA have similar pass rates, the CPA is often considered the harder exam as it has four parts whereas the CMA only has two. Both options can be deemed rewarding, but the data points to the conclusion that having both is the most lucrative situation.