The Regulation (REG) section of the Uniform CPA Examination (the Exam) tests the knowledge and skills that a newly licensed CPA must demonstrate with respect to:

- U.S. federal taxation

- U.S. ethics and professional responsibilities related to tax practice

- U.S. business law

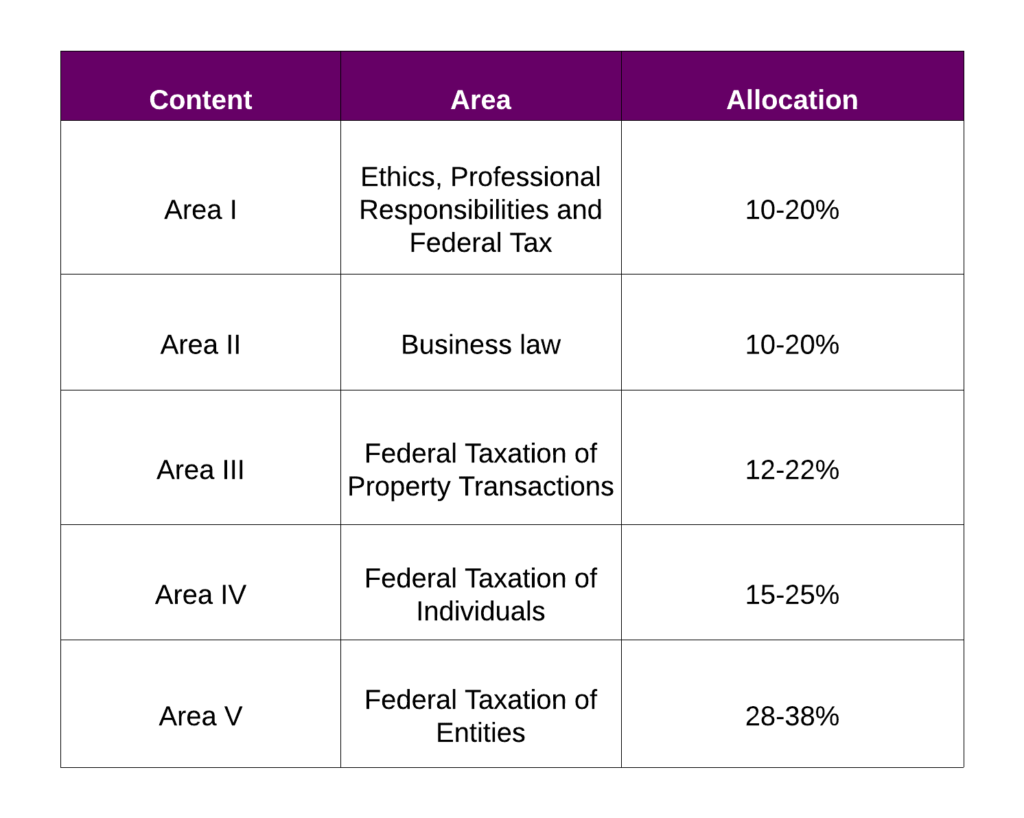

This is section is a tax-heavy section but will also test candidates on business law concepts as well as ethic issues. This exam is broken out into five content areas that you can better understand each respective layout by understanding the CPA exam blueprint under the regulation section:

Because candidates frequently ask us how to prioritize their time when studying for Regulation (REG), we are going to break out each of these content areas into bite-size strategies for each. Because it is evident that per the above chart issued by the AICPA, the area that is most heavily tested is the Federal Taxation for Entities portion. So, we decided that this area is a good place to start.

Entity Tax:

As you can see, the most heavily tested exam section is Federal Taxation of Entities. This is a section that tests candidates’ ability to differentiate the formation, taxation, and taxability of distributions for C corporations, S corporations and Partnership entities. When studying for the entity tax section of the Regulation (REG) exam, what is most critical to understand is beyond understanding and memorizing the rules for each of these respective entities, but to also be able to differentiate some of the small nuances and differences between each entity. There are three types of entities that you should thoroughly understand:

C Corporations – For a corporation to be delegated as a C Corp, a separate legal entity will be created under a state statute with the filing of its articles of incorporation with the corresponding state legal authority. The company’s shareholders will be considered the corporations owners, and they are the individuals who have the responsibility of electing the board of directors. A common theme regarding entity taxation is the CPA candidate’s ability to differentiate C corporations vs S corporations. The primary difference between the two entity types is that a C corporation will be taxed as a separate entity, while an S corporation will be taxed as a flow through entity, similar to a partnership. C corporations will fill file Form 1120 to the Internal Revenue Service when presenting their tax returns on an annual basis.

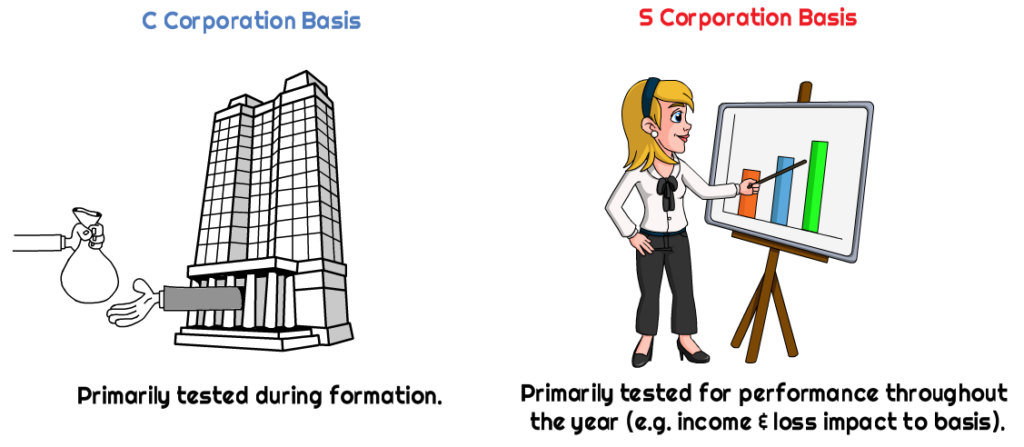

S Corporation – the formation of an S corporation will require an entity to first form a C corporation and then make a subsequent S election. Unlike C corporations, companies that elect S status will not be taxed at the entity level. Instead their income will be “passed through” to the shareholders of the corporation and will be taxed at the individual level (1040 tax return). In addition, S corporations must file form 1120S every year before the 15th day of the third month of the following tax year (March 15th). One of the key differences between a C corporation and an S corporation is the importance of the basis calculation for both C corps and S corps. C corporations will primarily recognize basis during the initial contribution of property whereas the basis of an S corporation will primarily be calculated during the current year’s activity.

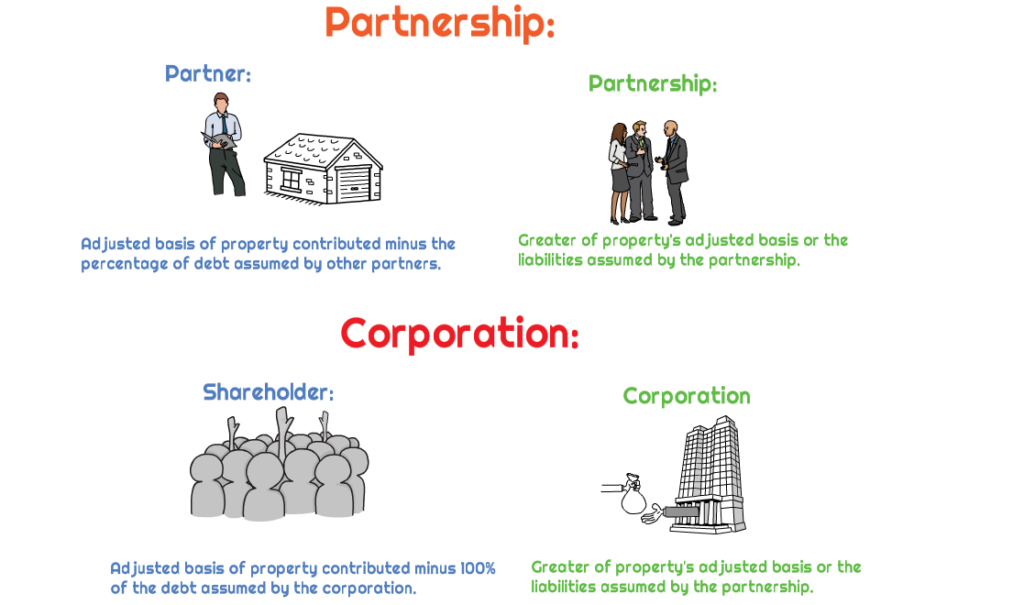

Partnership – Similar to S corporations, partnerships are taxed as passthrough entities. Partnerships are considered a separate entity and will thus recognize income as reported from the partnerships K-1 which will flow to the partners individual (1040) tax return. Partnerships will file Form 1065 which will not be taxed as a separate entity. One of the most important areas to focus on when it comes to differentiating partnerships from corporations is the calculation of basis. The focus for basis when it comes to partnership will be similar to C corporations in that it will be calculated during the initial formation. The only difference is how the partners will calculate basis in their partnership interest when acquiring partnership interest.