Many people do not know the difference between a CPA (Certified Public Accountant) and a CMA (Certified Management Accountant) and what qualifications are needed for both of them. They are similar in some ways, but also very different in other ways. They require different qualifications and certifications, but both career paths are highly regarded and unique in their own way. No matter which path you choose you will set yourself up for a reliable and successful career.

CPA

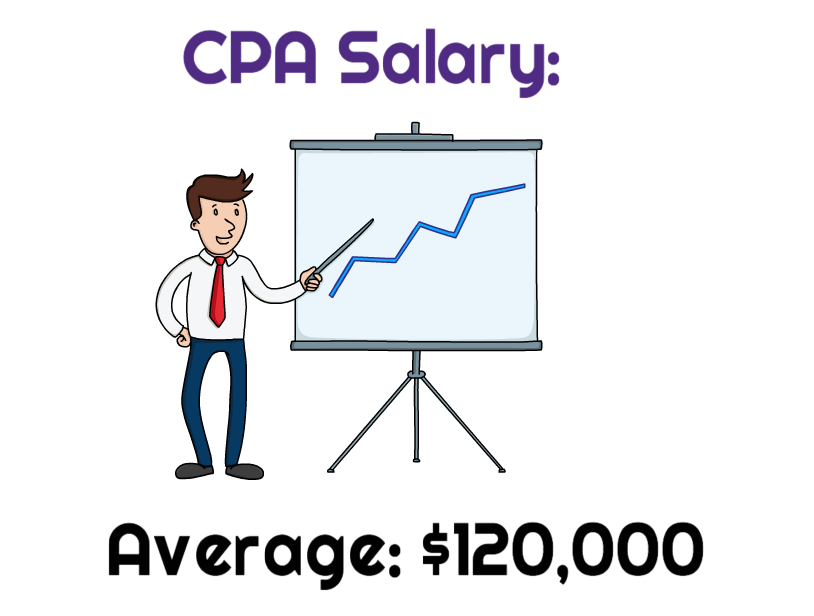

A Certified Public Accountant is considered to be an audit expert who can perform and sign audits. To be a CPA you must have a bachelor’s degree, a certain amount of work experience (usually 1 year of professional experience), and you must pass the CPA exam. The CPA exam is comprised of four parts that are taken separately. These parts include tax regulation, business, financial reporting, and audit. The degree is awarded by the American Institute of Certified Public Accountants (AICPA). Additionally, after obtaining the CPA certification you must maintain various levels of continuing educational development based on your state requirements (usually 40 hours) in order to stay active. CPA’s have a broader expansion of training that allow them to work in many different industries, and in both private and public sectors. If tax, auditing, consulting, and/or regulation interests you, then a CPA is a great avenue to explore.

CMA

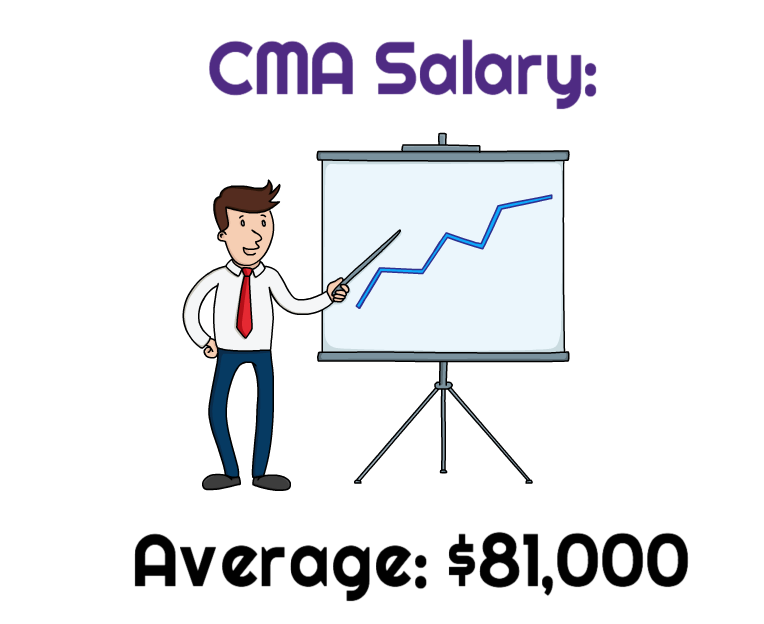

A Certified Management Accountant is an expert in financial accounting and strategic management. A CMA analyzes different data sets and strategizes in order to make business decisions based on financial information. Similar to a CPA, you must have a bachelor’s degree, prior work experience, and you must pass a certification test. The CMA degree is awarded by the Institutes Management Accountants (IMA). Similar to the CPA, once you have obtained the certification, you must take 30 hours of certified professional education per year to stay active. Generally, these courses are taken in person or via webcasts. CMA’s have more specialized training and therefore the job titles available are slightly more limited, but the certification still provides for great opportunities. CMA’s have the unique opportunity to analyze an entities financial health in order to make calculated business decisions.

Final Thoughts

First of all, both career paths are highly respected in the business world. Although both certifications are prestigious, the general thought is that the CPA license is more difficult to obtain. However, one may be more beneficial than the other simply based on personal preference and desired career path. Although they both operate in the financial world, the day to day responsibilities of both are very different. Both careers offer stable and well-paying jobs fairly early on in your career life that only get better with time. Additionally, both careers are critical to the health of a business and are necessary to keep a business alive. Chances are you will never have much difficulty finding a well-paying job with good benefits. If you truly can’t decide which on best fits your goals, then you might as well obtain both!